25+ mortgage front end ratio

Web Below mentioned is the formula to calculate the front-end DTI. Web Returning to the example above assume that out of the borrowers 2000 monthly debt obligation their mortgage payment comprises 1200 of that amount.

Compare Mortgages Mortgage Comparison And Get Advice

Web To calculate the front-end ratio divide the mortgage payment by the monthly income.

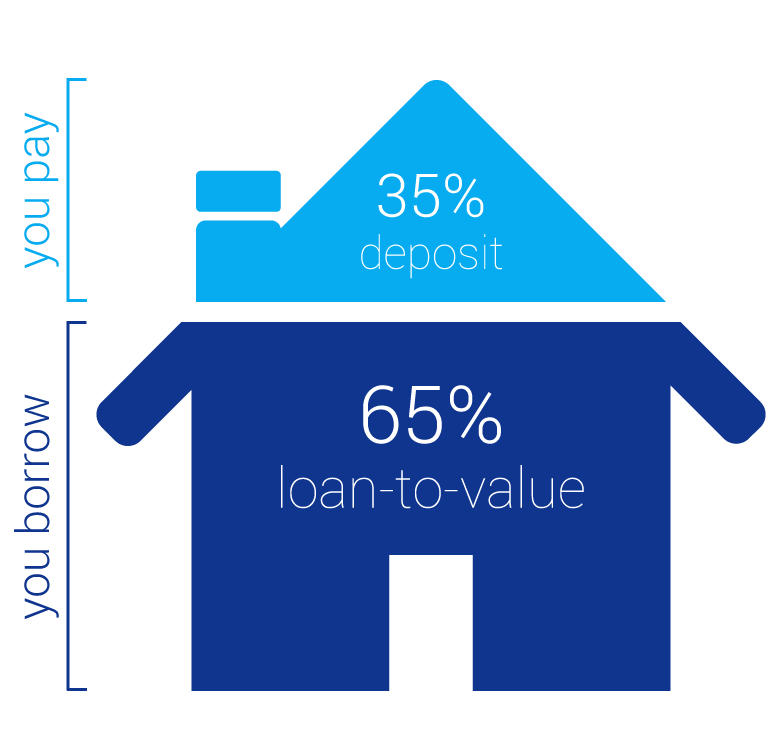

. The front-end ratio only considers your. Web The front-end ratio includes not only rental or mortgage payment but also other costs associated with housing like insurance property taxes HOACo-Op Fee etc. Loan Secured On Property.

The backend ratio adds your other monthly debt obligations. For FHA loans the front-end DTI ratio max is 31 while the back-end DTI ratio is capped at 43. According to the 2836 rule your mortgage payment -- including taxes.

Ad Try Our Free Eligibility Checker Now. Borrowers may go up to DTIs of 44 if their front-end. Web USDA loans.

Web The front-end ratio is only the ratio of your mortgage payment to your income. Web The front end ratio measures the ratio of your income which is devoted to housing-related expenses. Web Front-end ratios calculate the amount of gross income that goes towards housing costs.

Check If You Will Be Accepted - Before You Apply. No Impact On Credit Score. No Impact On Credit Score.

For example if the borrower owes 1500 in debt and 1000 of it. Web The front-end ratio is how much of your income is taken up by your housing expenses. Department of Agriculture mostly require a DTI of 41 or lower.

Front End Debt To Income Total Housing Expense Monthly Gross Income x 100. Lets take an example. Web In addition to your credit score your debt-to-income DTI ratios are looked at by closely by mortgage lenders when you apply for a loan.

Web The front-end ratio is known as the housing ratio and it divides your total monthly mortgage payment principal interest taxes and insurance or PITI by. If you earn 48000 per year your monthly income is 4000. Web Debt-to-income ratio.

Loan Secured On Property. Check If You Will Be Accepted - Before You Apply. Ad Try Our Free Eligibility Checker Now.

This ratio is extremely important in. Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage. For a homeowner the front-end ratio can be calculated by adding up all.

Loans guaranteed by the US.

:max_bytes(150000):strip_icc()/DTI-00b75c561c624a839a2a6902faf3d751.jpg)

What Debt To Income Ratio Do You Need For A Mortgage

Debt To Income Ratio For Mortgages Explained

How Does A Cash Out Refinance Work In Houston Texas

25 Kpis And Metrics For Finance Departments In 2021 Insightsoftware

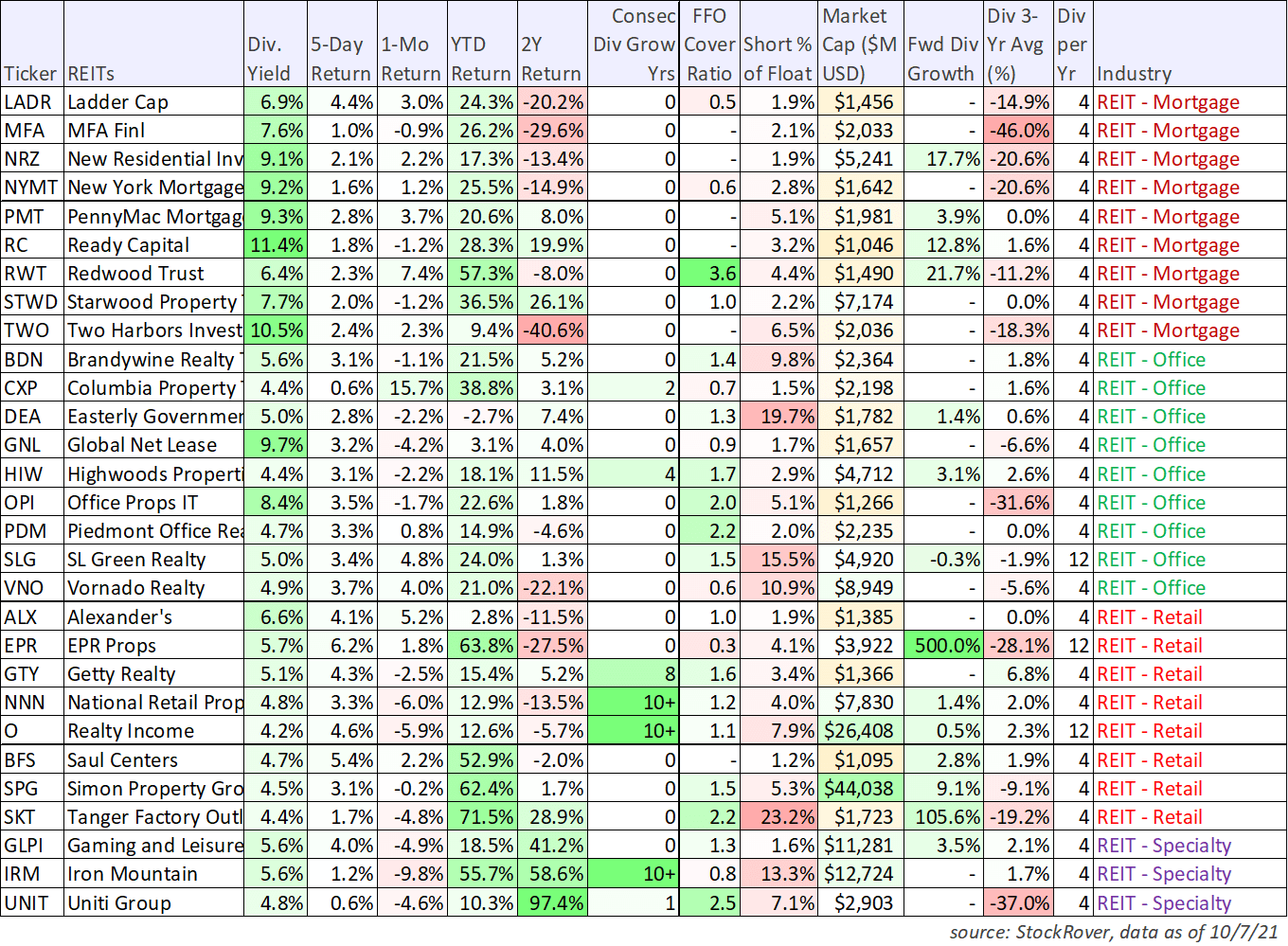

100 Big Dividend Reits Bdcs Cefs Mlps 4 Worth Considering Seeking Alpha

Mortgage Calculator

Debt To Income Ratio Dti What It Is And How To Calculate It

Dallas Fha Loan Limits For 2021 Texas United Mortgage

One Hdfc By Marc Rubinstein Net Interest

My Credit Score Is Consistently Lower Than It Should Be Because I M 23 Guess I Should Have Had Credit At 2 Years Old R Assholedesign

:max_bytes(150000):strip_icc()/how-much-income-do-you-need-to-buy-a-house-5204854_round1-4f047b26eafb4357ac26507a56ef49f6.png)

What Debt To Income Ratio Do You Need For A Mortgage

Need A Mortgage Keep Debt Levels In Check The New York Times

:max_bytes(150000):strip_icc()/MortgateRates.Fed.StL-0099d59e398e4f239bc0cc4154e04cb7.jpg)

Mortgage Calculator

Maynard Paton Fw Thorpe Record H1 Results Reveal Thorlux Orders Up 25 And Another Special Dividend As Companies Scramble For Energy Efficient Lighting

The Reminder November 19 25 2019 By Beacon Communications Issuu

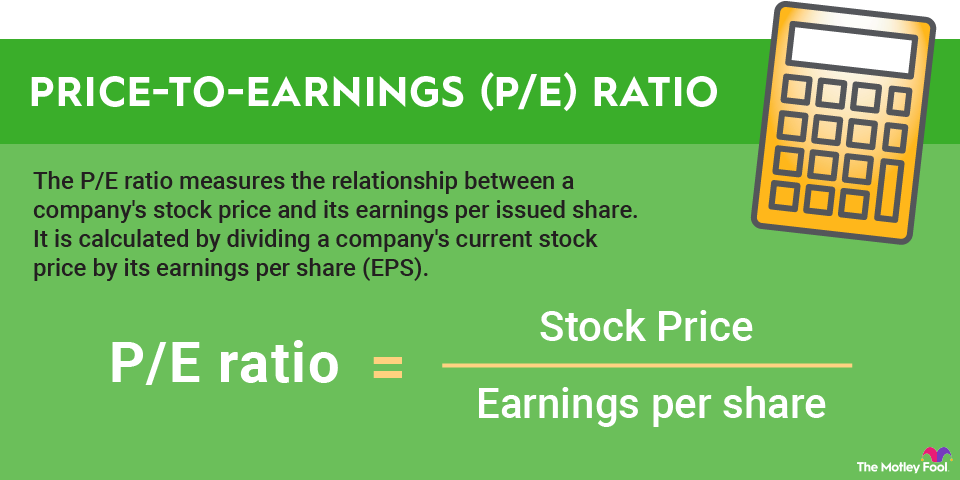

Using The Price To Earnings P E Ratio To Assess A Stock The Motley Fool

Debt To Income Ratio Mortgage Investors Group